If you're an insurance professional eager to enhance efficiency and customer satisfaction, embracing QR codes is a good idea.

In this article, I'll show practical ways that you can implement QR codes to streamline operations, boost client interactions, and stay ahead in the competitive insurance market.

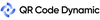

The Importance of QR Codes in the Insurance Industry

Meeting Modern Consumer Demands

Everyone expects instant access to information. Your clients don't want to wait—they want quick, convenient interactions with their insurance providers. By using QR codes, you can meet these expectations head-on.

- Clients can scan a QR code to view policy details, submit claims, or contact support immediately.

- No more logging into portals or waiting on hold during phone calls.

- Providing quick solutions boosts client satisfaction and loyalty.

Staying Competitive in a Digital Age

The insurance industry is rapidly evolving, with new technologies setting companies apart. Embracing innovations like QR codes is crucial to stay ahead of the competition.

- Stand out from competitors still using outdated methods.

- Demonstrate to clients that you're a forward-thinking company.

- Appeal to a growing market segment that values digital solutions.

Enhancing Operational Efficiency

Think about how much time your team spends on manual tasks like data entry and paperwork. QR codes can streamline these processes significantly.

- Scanned information goes directly into your systems.

- Minimize mistakes caused by manual entry.

- Faster processes mean quicker service for your clients.

Example: Instead of filling out lengthy forms, clients can scan a QR code to auto-fill their information when submitting a claim. This saves them time and reduces the workload on your staff.

Using QR Codes in Your Insurance Business

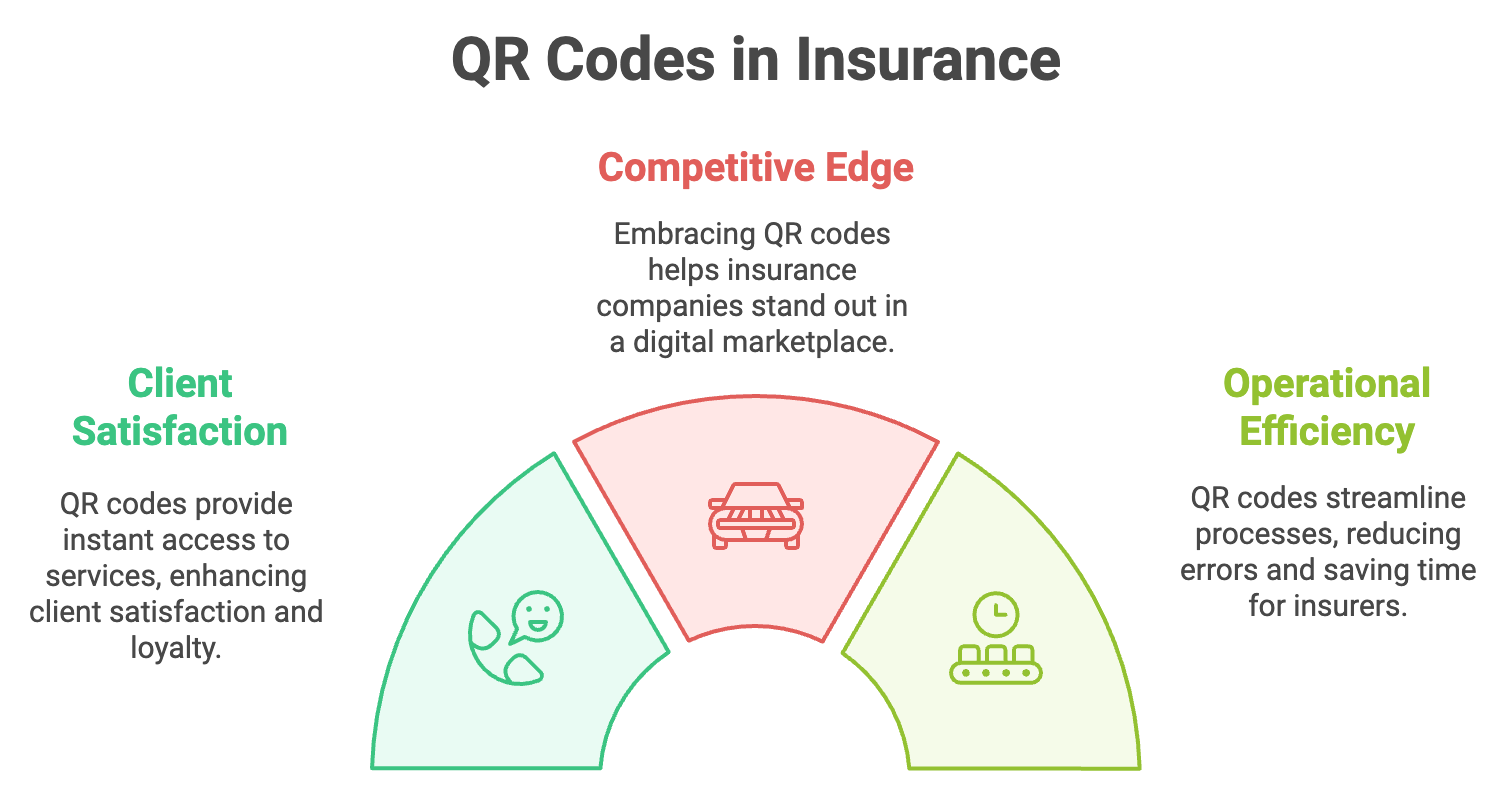

QR codes are a practical tool to improve customer engagement and streamline processes in your insurance business. Follow these simple steps to create and use QR codes effectively with QR Code Dynamic.

Step 1: Choose QR Code Type

- Static QR Codes: Best for fixed information that doesn’t need updates (e.g., office address or contact details).

- Dynamic QR Codes: Ideal for information that may change (e.g., policy details, links to new promotions). You can change the link without changing the QR code any time.

💫 If you dont know the main difference between these two, you should check it out: What are the Differences Between Static & Dynamic QR Codes

Tip: Dynamic QR codes are a better fit for insurance businesses because they allow you to track how often codes are scanned and adjust linked information as needed.

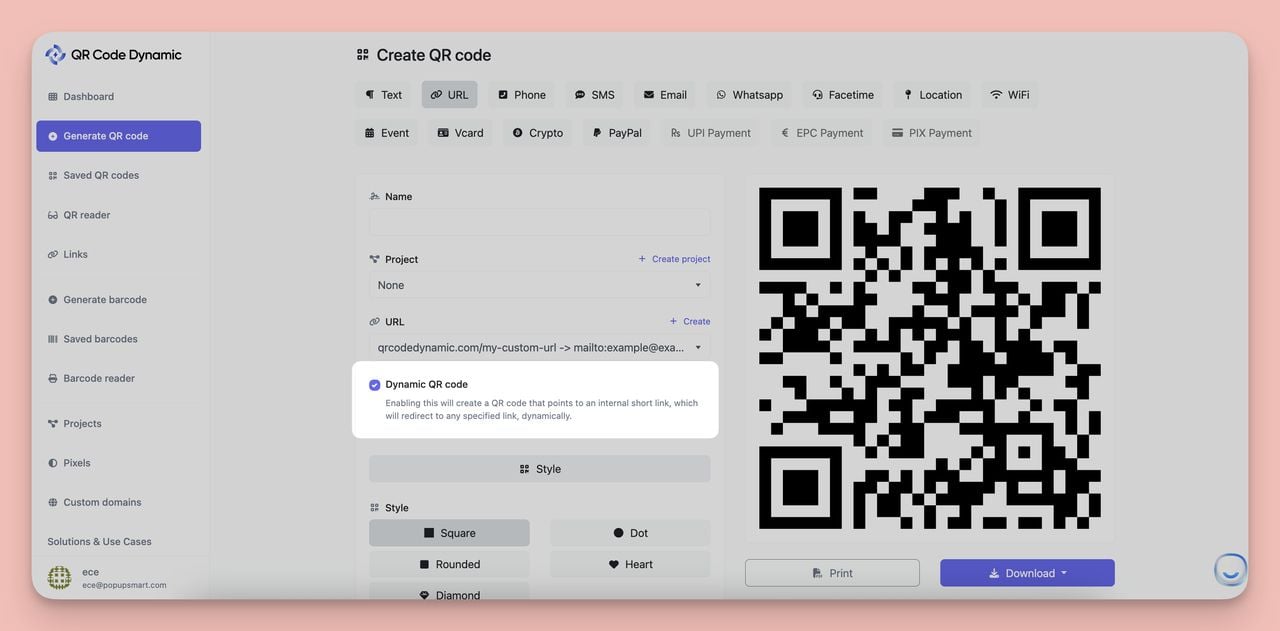

Step 2: Customize Your QR Code

QR Code Dynamic offers many customization options to make your QR codes more engaging and on-brand:

- Colors: Change the colors of the QR. Use your company’s colors for the code.

- Logo: Add your business logo to the center of the QR code.

- Style: Adjust the shape of the QR code and its "eyes" (corners of the code) for a unique design.

Design Tips:

- Make sure there’s enough contrast between the QR code and the background so it’s easy to scan.

- Keep the QR code size large enough for scanning (at least 2 x 2 cm for printed materials).

- Test different styles to ensure the code works with your design.

Step 3: Test Before Using

Before using your QR code, test it to avoid issues:

- Scan with multiple devices: Try it on different smartphones and apps.

- Check the link: Ensure it directs users to the correct content.

- Test in real conditions: For example, if the QR code will be displayed in a well-lit area, test it under similar lighting.

Step 4: Deploy the QR Code

Once your QR code is ready, share it with your clients through:

- Printed Materials: Add QR to business cards and use QR on flyers, brochures, and invoices.

- Digital Channels: Use it in emails, newsletters, and your website.

- Physical Locations: Place it in your office or at events.

Tips for Effective Use:

- Place the QR code where clients can easily notice and scan it.

- Add a clear QR code call-to-action, like “Scan to view your policy” or “Scan to file a claim.”

Best Practices

- Strategic Placement: Ensure QR codes are at a convenient height and free from clutter.

- Clear Instructions: Include a short explanation of what the QR code does, such as “Scan to get instant updates on your policy.”

- Mobile-Friendly Links: Make sure the linked pages load quickly and work well on mobile devices.

- Monitor Performance: Use analytics to track how many people scan your QR codes and adjust your strategy if needed.

Benefits of Implementing QR Codes for Insurance Companies

🟢 Streamlined Claims Processing

We all know that processing insurance claims can be time-consuming and frustrating for both you and your clients. But what if you could make it faster and easier? By integrating QR codes into your claims process, you can:

- Clients can scan a QR code to access online claim forms instantly.

- Allow clients to upload photos and documents directly through a linked portal.

- Automated data entry means less manual processing on your end.

Imagine a client getting into a minor car accident. Instead of filling out lengthy forms, they simply scan a QR code on their insurance card, fill in the details on their phone, and submit photos of the damage immediately.

🟢 Improved Customer Experience

Your clients value convenience and quick access to information. QR codes help you meet these expectations by:

- Clients can scan a code to view their coverage, renewal dates, and more.

- QR codes can link to customer service chatbots or support pages for immediate assistance.

- Direct clients to download your insurance app with a simple scan.

By making interactions seamless, you satisfy your clients and build stronger relationships with them.

🟢 Cost Reduction and Sustainability

Looking to cut costs and promote eco-friendly practices? QR codes can help:

- Provide digital documents and resources via QR codes instead of printed materials.

- Update information digitally without reprinting brochures or flyers.

- Show your environmental commitment, which can enhance your brand's reputation.

For example, instead of mailing out paper policy updates, you can send clients a QR code that links to the latest information online.

🟢 Enhanced Data Accuracy and Security

Data accuracy and security are crucial in the insurance industry. QR codes contribute by:

- Digital forms reduce mistakes that often occur with handwritten documents.

- Use encrypted or password-protected QR codes to safeguard sensitive data.

- Ensure you're meeting data protection laws by controlling access to information.

Actionable Tips:

Begin by adding QR codes to your business cards or brochures that link to your website or contact information. Let your clients know how to use QR codes and the benefits they offer. Use dynamic QR codes so you can track usage and update content as needed.

QR Codes in the Insurance Industry: Use Cases

Let's explore practical ways you can use QR codes to enhance your insurance business.

- Simplify Claims: Use QR codes for easy claim submissions.

- Access Policies Anywhere: Provide instant digital access to policy details.

- Secure Payments: Make premium payments effortless and secure.

- Enhance Marketing: Boost campaigns with interactive QR codes.

- Engage Clients: Strengthen relationships through easy contact sharing and app downloads.

- Streamline Renewals: Simplify the renewal process to prevent coverage gaps.

- Gather Feedback: Improve services by collecting client opinions via feedback QR codes.

1. Simplifying Claims Submission

Filing an insurance claim can be a daunting task for clients. QR codes can make this process a breeze.

- Place a QR code on insurance cards or policy documents that links directly to online claim forms.

- Clients can upload photos and necessary documents straight from their smartphones.

- Automated data entry speeds up claim approvals, making your clients happier.

2. Instant Access to Policy Details

Clients often need quick access to their policy information. QR codes provide a convenient solution.

- Include QR codes that link to digital versions of policy documents.

- Any changes to policies can be reflected instantly without reissuing physical documents.

- Reduce paper usage by offering digital access.

3. Facilitating Secure Payments

Making payments should be easy and secure. QR codes streamline the payment process.

- Embed QR codes on receipts that link to payment gateways.

- Clients can choose their preferred payment method after scanning.

- Minimize mistakes associated with manual entry of payment details.

4. Enhancing Marketing Strategies

Boost your marketing efforts by integrating QR codes into your campaigns.

- Place QR codes on print ads that link to promotional videos or special offers.

- Use dynamic QR codes to monitor scan rates and adjust strategies accordingly.

- QR codes can link to social media pages, increasing your online presence.

5. Boosting Customer Engagement

Strengthen your relationship with clients through QR codes.

- Share contact details effortlessly by adding QR codes to business cards.

- Encourage clients to download your mobile app for easier access to services.

- Provide access to webinars, tutorials, or informational articles via QR codes.

6. Streamlining Policy Renewals

Make policy renewals hassle-free for both you and your clients.

- QR codes can take clients straight to online renewal applications.

- Send emails or messages with QR codes as reminders when renewal dates approach.

- Simplifying renewals encourages timely client action.

7. Gathering Customer Feedback

Understanding your clients' experiences helps you improve your services.

- After a service interaction, provide a QR code linking to a feedback survey.

- Quickly gather and analyze client opinions.

- Use feedback to make data-driven improvements.

Conclusion

QR codes are transforming the insurance industry by streamlining operations, enhancing customer experiences, and reducing costs.

By integrating QR codes into your business processes—whether for claims submissions, policy renewals, or marketing—you can stay ahead of the competition and provide the convenience and efficiency modern clients expect.

Start small, track results, and refine your strategy to unlock the full potential of this simple yet powerful tool.

FAQs

1. How do QR codes improve efficiency in insurance operations?

QR codes streamline processes like claims submission, payments, and accessing policy information, reducing manual work and speeding up services.

2. What are the security considerations when using QR codes in insurance?

Use secure QR code generators, implement encryption, and use password protection to safeguard sensitive client data.

3. Can QR codes help reduce operational costs for insurance companies?

Yes, by minimizing paper usage, reducing printing costs, and automating processes, QR codes can significantly lower operational expenses.